Ungabala kanjani umsebenzi wase-Australia kanye ne-GST uma ungenisa usuka e-China uya e-Australia?

Ungabala kanjani umsebenzi wase-Australia kanye ne-GST uma ungenisa usuka e-China uya e-Australia?

Umsebenzi wase-Australia/i-GST ikhokhelwa amasiko e-AU noma uhulumeni ozokhipha i-invoyisi ngemva kokukhipha imvume ye-Customs yase-Australia

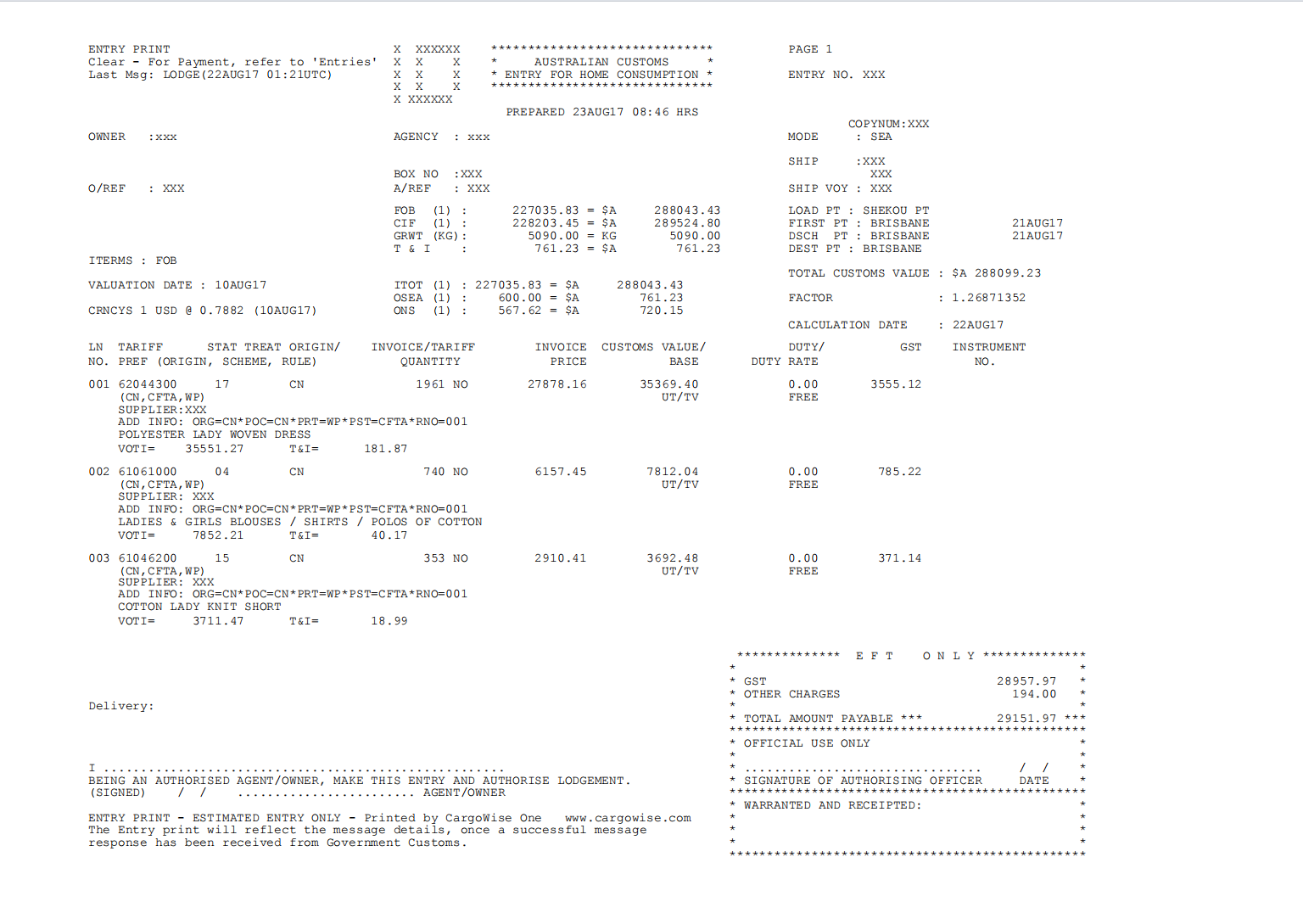

I-invoyisi yase-Australian duty/GST iqukethe izingxenye ezintathu okuyi-DUTY, GST kanye ne-ENTRY CHARGE.

1.Umsebenzi uncike ekutheni hlobo luni lwemikhiqizo.

Kodwa njengoba i-China isayine isivumelwano sohwebo lwamahhala ne-Australia, uma ukwazi ukunikeza isitifiketi se-FTA, imikhiqizo engaphezu kuka-90% evela e-China ayikhokhiswa intela. Isitifiketi se-FTA sibizwa nangokuthi isitifiketi se-COO futhi sisetshenziselwa ukukhombisa ukuthi imikhiqizo yenziwa eChina.

I-2.GST ingxenye yesibili okudingeka uyikhokhe ku-AU Customs uma ungenisa usuka e-China.

I-GST ingu-10% yenani lempahla okulula ukuliqonda

3.Inkokhelo yokungenela ingxenye yesithathu ezokhokhiswa amasiko e-AU futhi ibizwa nangokuthi njengezinye izindleko. Ihlobene nenani lempahla ngokuvamile elisuka ku-AUD50 liye ku-AUD300.

Ngezansi isibonelo se-invoyisi ye-Australian duty/gst ekhishwe amasiko e-AU :

Nokho, uma inani lempahla yakho lingaphansi kuka-AUD1000, ungafaka isicelo se-zero AU duty/gst. Amasiko ase-Australia ngeke akhiphe i-invoyisi

For more information pls visit our website www.dakaintltransport.com or email us at robert_he@dakaintl.cn or telephone/wechat/whatsapp us at +86 15018521480

IMIKHAKHA YENKONZO YOKUTHUMELA

-

Ucingo

-

I-imeyili

-

Whatsapp

-

I-WeChat

-

Phezulu